Smart Home Insurance Market Size Projection 2024

In 2031, Smart Home Insurance Market is poised for substantial growth, presenting a myriad of opportunities for investors and businesses alike. With technological advancements driving innovation and consumer preferences evolving rapidly, the market is primed for expansion across various sectors. From transformative breakthroughs in healthcare to revolutionary developments in renewable energy, the landscape is ripe with potential. Forward-thinking companies leveraging cutting-edge technologies and embracing sustainable practices are positioned to thrive in this dynamic environment. As globalization continues to blur geographical boundaries, emerging markets offer untapped avenues for growth, while established markets provide platforms for consolidation and diversification. In this era of unprecedented change and opportunity, strategic foresight and agility will be crucial for organizations to capitalize on the growth trajectory of the Smart Home Insurance Market in the coming years.

Request PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.marketresearchintellect.com/download-sample/?rid=1076845&utm_source=Llanocj&utm_medium=019

Key Points Smart Home Insurance Market Size Projection in 2024

-

Technological Advancements:Continuous innovation and improved functionalities in Smart Home Insurance products are crucial drivers of market growth. Companies are investing in cutting-edge technologies to enhance product performance, reliability, and user experience. These advancements not only attract new customers but also retain existing ones by meeting evolving demands.

-

Increasing Consumer Demand:There is a growing preference for Smart Home Insurance solutions among consumers, fueled by their effectiveness, efficiency, and convenience. As more individuals and businesses recognize the benefits of Smart Home Insurance, the market is expected to see a substantial rise in demand, contributing to overall growth.

-

Expanding Applications:The adoption of Smart Home Insurance across various industries, including healthcare, finance, and manufacturing, is broadening the market’s scope. Each sector leverages Smart Home Insurance solutions to optimize operations, reduce costs, and improve service delivery, which in turn drives market expansion.

-

Strategic Partnerships:Collaborations and alliances are essential for enhancing market reach and capabilities. Strategic partnerships enable companies to combine expertise, share resources, and access new markets more effectively, fostering growth and innovation within the Smart Home Insurance market.

-

R&D Investments: Increased funding for research and development is pivotal in driving product innovation. Companies are allocating substantial budgets to R&D to develop new Smart Home Insurance solutions, improve existing ones, and stay competitive in a rapidly evolving market.

-

Market Valuation:The Smart Home Insurance market is projected to reach a significant financial milestone by the end of 2024. This valuation reflects the market’s robust growth prospects and the increasing adoption of Smart Home Insurance solutions worldwide.

-

CAGR:The strong compound annual growth rate (CAGR) indicates robust market growth. A high CAGR signifies sustained expansion and increasing revenue over the forecast period, highlighting the market’s potential.

-

Emerging Smart Home Insurance Market: Rising adoption in developing regions is contributing significantly to market expansion. Emerging markets offer vast opportunities due to their large populations, improving economic conditions, and growing technological infrastructure, making them key targets for Smart Home Insurance market growth.

-

New Sector Adoption: The penetration of Smart Home Insurance solutions into previously untapped sectors is creating new growth avenues. As more industries discover the advantages of Smart Home Insurance market, the market will continue to diversify and expand, reaching new heights in 2024 and beyond.

Get a Discount On The Purchase Of This Report @ https://www.marketresearchintellect.com/ask-for-discount/?rid=1076845&utm_source=Llanocj&utm_medium=019

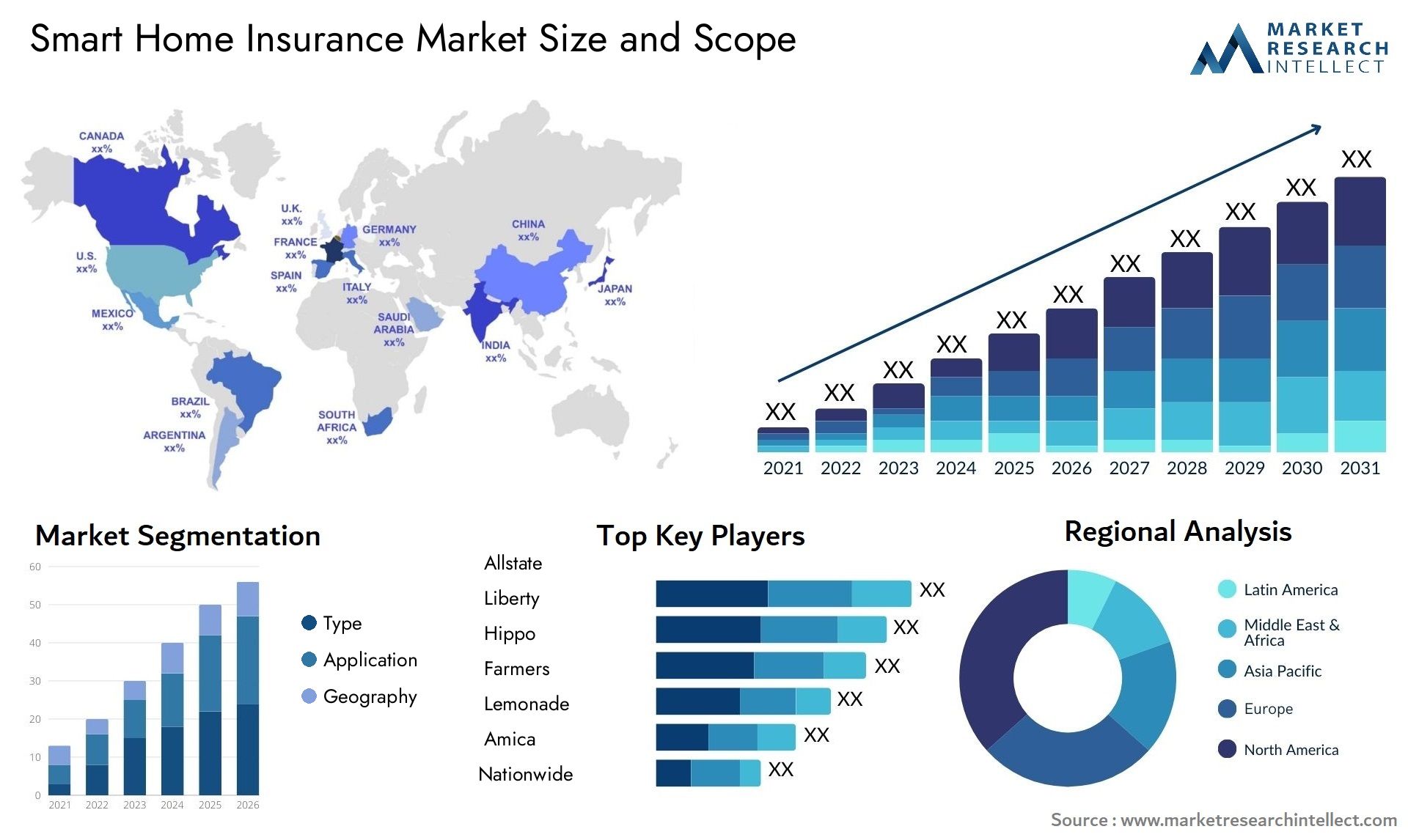

Smart Home Insurance Market Segmentation Analysis

Segmentation analysis involves dividing the market into distinct groups based on certain criteria such as type and application. This helps in understanding the market dynamics, targeting specific customer groups, and devising tailored marketing strategies.

By Type

- Device-specific

- Endorsements or Add-ons

- System-wide

By Application

- Residential

- Commercial

Major companies

- Nationwide

- Amica

- Lemonade

- Farmers

- Hippo

- Liberty Mutual

- Allstate

- AmFam

- State Farm

- USAA

- Locket

- AXA

- Vivint

- Savvi

- Zurich Insurance

- TD Insurance

- Rogers

- Travelers Insurance

- AAA

- Honey

- SmartInsure

Global Smart Home Insurance Market Regional Analysis

North America:

- Major Players: United States, Canada

- Strengths: Robust economy, technological advancements, strong consumer base with high purchasing power

- Opportunities: Innovation, market leadership, consumer demand

- Challenges: Competition, regulatory environment

Europe:

- Major Players: United Kingdom, Germany, France, Italy

- Strengths: Mature market, well-established infrastructure, consumer preferences

- Opportunities: Market stability, brand recognition, innovation

- Challenges: Saturation, regulatory compliance

Asia-Pacific:

- Major Players: China, Japan, India, South Korea

- Strengths: Rapidly growing market, large population, rising disposable income, urbanization

- Opportunities: Expansion, market penetration, diverse consumer base

- Challenges: Cultural differences, regulatory complexities

Latin America:

- Major Players: Brazil, Mexico, Argentina

- Strengths: Opportunities for growth, emerging market dynamics

- Opportunities: Untapped markets, consumer demand

- Challenges: Economic fluctuations, political instability

Middle East and Africa:

- Major Players: UAE, Saudi Arabia, South Africa, Nigeria

- Strengths: Emerging markets, economic diversification, urbanization, young population

- Opportunities: Market development, investment potential

- Challenges: Infrastructure development, geopolitical risks

Frequently Asked Questions (FAQ in Smart Home Insurance Market)

What is the current size and future outlook of the Smart Home Insurance Market?

- Answer: The Smart Home Insurance Market is projected to grow at a compound annual rate of XX% from 2024 to 2031, transitioning from USD XX Billion in 2023 to USD XX billion by 2031.

What is the present condition of the Smart Home Insurance market?

- Answer: As per the latest data, the Smart Home Insurance market is showing signs of growth, stability, and encountering certain challenges.

Who are the major players in the Smart Home Insurance market?

- Answer: Key players in the Smart Home Insurance market are notable companies recognized for their distinct characteristics or strengths.

What are the driving forces behind the growth of the Smart Home Insurance market?

- Answer: Growth in the Smart Home Insurance market is propelled by factors such as technological advancements, rising demand, and regulatory support.

What challenges are impacting the Smart Home Insurance market?

- Answer: Challenges facing the Smart Home Insurance market include competition, regulatory complexities, and economic factors.

For More Information or Query, Visit @ Global Smart Home Insurance Market Size And Forecast

Table of Contents (Smart Home Insurance Market):

1. Introduction of the Smart Home Insurance Market

- Overview of the Market

- Scope of Report

- Assumptions

2. Executive Summary

3. Research Methodology of Market Research Intellect

- Data Mining

- Validation

- Primary Interviews

- List of Data Sources

4. Smart Home Insurance Market Outlook

- Overview

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Porters Five Force Model

- Value Chain Analysis

5. Smart Home Insurance Market, By Product

6. Smart Home Insurance Market, By Application

7. Smart Home Insurance Market, By Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

8. Smart Home Insurance Market Competitive Landscape

- Overview

- Company Market Ranking

- Key Development Strategies

9. Company Profiles

10. Appendix

About Us: Market Research Intellect

Market Research Intellect is a leading Global Research and Consulting firm servicing over 5000+ global clients. We provide advanced analytical research solutions while offering information-enriched research studies. We also offer insights into strategic and growth analyses and data necessary to achieve corporate goals and critical revenue decisions.

Our 250 Analysts and SMEs offer a high level of expertise in data collection and governance using industrial techniques to collect and analyze data on more than 25,000 high-impact and niche markets. Our analysts are trained to combine modern data collection techniques, superior research methodology, expertise, and years of collective experience to produce informative and accurate research.

Our research spans a multitude of industries including Energy, Technology, Manufacturing and Construction, Chemicals and Materials, Food and Beverages, etc. Having serviced many Fortune 2000 organizations, we bring a rich and reliable experience that covers all kinds of research needs.

For inquiries, Contact Us at:

Mr. Edwyne Fernandes

Market Research Intellect

APAC: +61 485 860 968

EU: +44 788 886 6344

US: +1 743 222 5439